How to Spot a Fake Check

Even in today’s digital age where everything can be done from your mobile phone including money transfers, some people may still prefer the assumed security of paper cashier’s checks or official bank checks for large or major payments. But unfortunately, criminals have come to rely on their victim’s sense of “security.” It’s easier now than ever for scammers to create fraudulent checks in a matter of minutes—fake checks look so real that it can be hard to detect.

But while counterfeit checks can be hard to detect, here are a few things that you can do to help identify fake checks:

- Make sure the check was issued by a legit bank. A fake name is a sure giveaway.

- Look up the bank that supposedly issued the check to make sure it’s real and the phone number on the bank’s official website. (Tip: Don’t use the phone numbers on the check – it could be controlled by the scammer) Call the official number and ask them to verify the check.

- Consider how and why you received the check. If you someone you don’t know initiated the payment, proceed cautiously.

- Tip: Scammers usually communicate via email/text and their communication may contain poor grammar and spelling errors.

- Identify where the check was mailed from. Be cautious if it was mailed from overseas.

- Determine if the amount of the check is correct/as expected. Fake checks are often made out for more than the agreed amount.

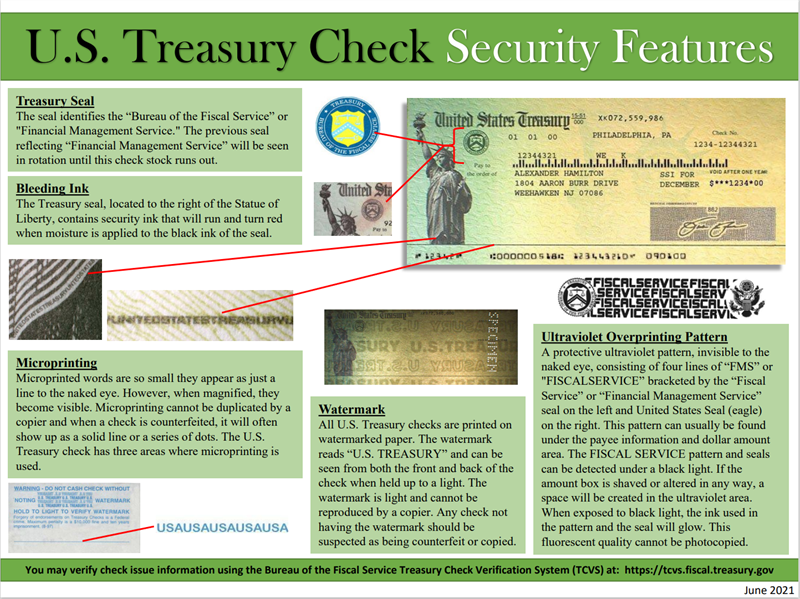

- Official checks usually contain watermarks, security threads, color-changing ink, and other security features. While scammers can copy these features, the quality is often poorly executed.

If you think you’ve been targeted by a counterfeit check scam, report it immediately to any of the following agencies:

- The Federal Trade Commission

- The U.S. Postal Inspection Service at www.uspis.gov (if you received the check in the mail).

- Your state or local consumer protection agencies.

- For possible online crimes involving counterfeit checks and money orders, file an online complaint with the Internet Crime Complaint Center (a joint project of the FBI and National White Collar Crime Center).

Visit the FGB Fraud Center for more information on how we recognize fraud. If you have questions, please call our Customer Support Center at 888-375-3093.