Four Tips to Help Build Your Credit

Adapted from Credit Aware powered by SavvyMoney

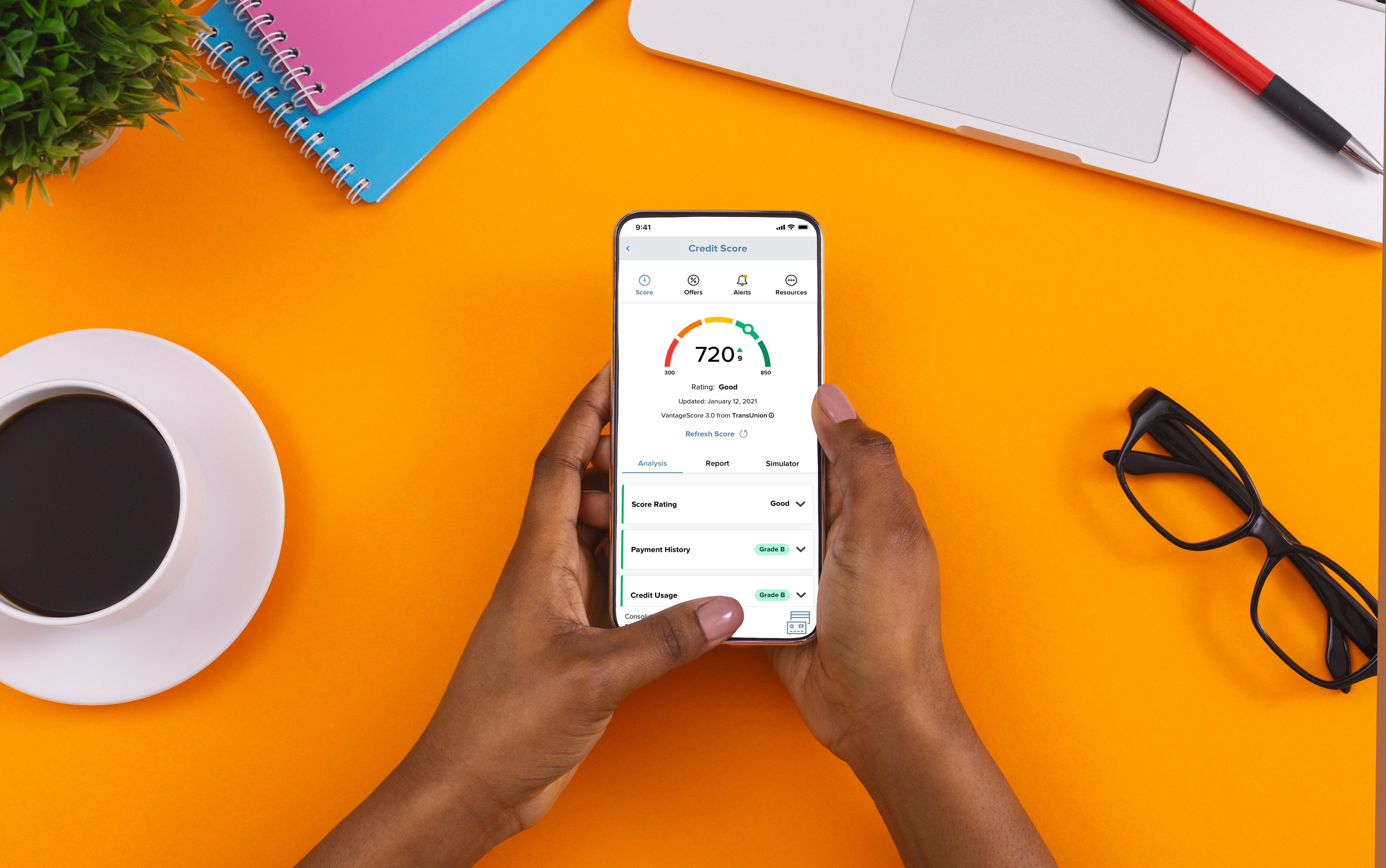

Your credit history can play a huge role in your future access to credit, loans, jobs, housing, insurance, and other important services. Typically, the higher your credit score, the better. Here are a few tips to help improve your credit score:

Tip #1: Aim to use 30% or less of your available credit.

As your spending goes up, your amount of available credit can go down. This is called Credit Usage.

Tip #2: Set up a game plan for short term – vacation, and long term – retirement, goals.

Keep your eyes on the prize and avoid temptation. Use our FREE Savings Goals worksheet to help track your goals!

Tip #3: Trick yourself into saving more by increasing your contributions.

Start by saving 5% of your pay, then raise the bar every few months!

Tip #4: Maximize your score.

A higher credit score can mean lower interest rates, which can then translate into money saved.

----------------------------------------------------

Learn more about Borrowing Basics here.

For more information on Credit Aware, click here.