Borrowing Basics

Adapted from the FDIC’s Money Smart Program

Ways to Borrow Money and What it Costs

There are different ways you can borrow money. From credit cards, to mortgages, to all of the different loan types in between, it largely depends on what you can afford and your specific situation.

.jpg?sfvrsn=b6a070b1_2&MaxWidth=800&MaxHeight=800&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=9E807BCB34C7050FA84CF4812F574326B799A0B2)

NOTE: Be sure you can afford payments BEFORE getting a loan. (Click here for our calculators)

Types of Loans

- Installment Loans

Usually repaid in equal payments over a set period and are best used for large purchase or consolidation. Examples include most fixed rate mortgages, auto loans, and student loans.

-

Revolving Loans

Repaid based on how much you have borrowed and are best used for emergency expenses or short-term purchases with anticipated payoff between 6-12 months. Examples include most credit cards and home equity lines of credit.

Both installment loans and revolving loans can be considered secured and unsecured loans. With asecured loan, you’ll be required to put some collateral down such as your house, vehicle, or cash. This is so that if you can’t pay the loans, your collateral will be used to pay some or all the loan. An unsecured loan does not require collateral and often has higher interest rates.

The Costs of Borrowing Money

It’s important to know that there are costs associated with borrowing money. In general, you’ll often end up paying more money than you borrowed thanks to interest.

- Interest is the amount of money a financial institution charges for allowing you to use its money.

- Fees may be charged for certain activities like reviewing your loan application and servicing the account. Examples include origination fees for home mortgages or late fees if you don’t make payments on time.

- Prepayment is the early repayment of ALL or PART of a loan. Prepaying your loan in full will lessen the interest if you no longer owe any money. But even prepaying part of your loan could help reduce interest costs and reduce the length of the loan.

- NOTE: Some loans have prepayment penalties!

Truth in Lending/ Comparing Offers

The Federal Truth in Lending Act or TILA requires lenders to give prospective borrowers a written disclosure that states the loan terms in a clear and uniform manner. You’ll receive the TILA before you sign your loan, and it can help you compare loans from different lenders. It can also help you decide if you can afford the loan payments comfortably each month.

| Annual Percentage Rate | Finance Charge | Amount Financed | Total of Payments |

| The cost of your loan as a yearly rate | The dollar amount the loan will cost you | The amount of the money provided to you on your behalf | The amount you will have paid after you have made all payments as scheduled |

| 12.00% | $600.00 | $5,000.00 | $5,600.00 |

Sample TILA disclosure.

NOTE: Disclosures for mortgages (home loans) and some student loans will look different.

When you’re ready to borrow money, be sure to shop around to get the loan that works best for you. Remember to use the TILA disclosures and pay attention to the APRs to compare the offers.

Preparing to Apply for a Loan

It’s important to remember that methods and factors may vary by lender, but typically, a lender will determine whether you’re a good credit risk—are you likely to pay the loan back as agreed? A few key factors that lenders may use include: (also known as the Four or Five Cs):

- Credit: (sometimes called character) how you have paid your bills or debts according to your credit reports

- Capacity: your present and future ability to meet payments

- Capital: the value of your assets and net worth

- Collateral: (for secured loans only) the assets you offer to secure the loan

- Conditions: (not used by all lenders) how you plan to use the money

What is Listed in a Credit Report?

Your credit history can play a HUGE role in gaining access to credit, loans, etc. Your name, address, and other identifying information is listed in a credit report, as well as your debts/some bills (think credit cards too), public record information, and your applications for new credit.

There CAN be errors on your credit report. But don’t panic. You are the best person to identify these errors. Double check your name, address, accounts opened, and that all other information is up to date.

CREDIT TIP: If you find errors on your credit reports, file a dispute, keep records, and follow up.

You can use websites like Equifax, Experian, and TransUnion to submit forms on errors found on your credit reports. Or you can send a letter to the credit reporting agency that has the incorrect information via certified mail (be sure to request a return receipt).

CREDIT TIP: Credit reporting agencies MUST investigate your dispute within 30 days of receipt of your dispute unless they consider it frivolous. (To help avoid this, be sure to include enough information/evidence.)

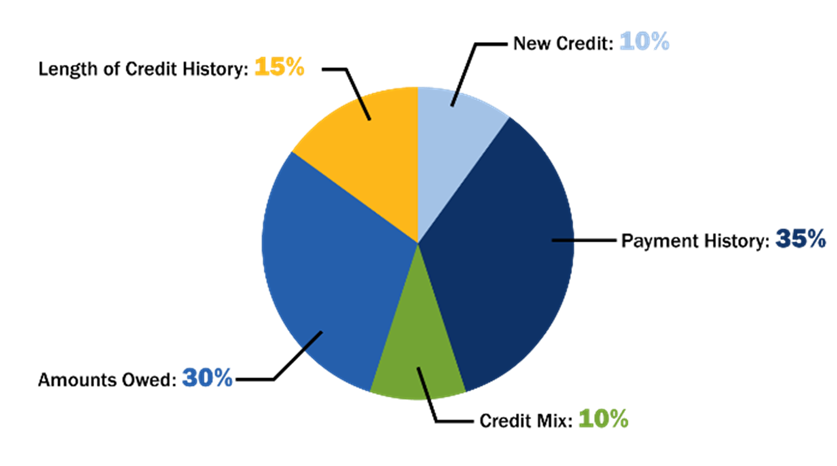

Five Factors in the General FICO Model

Question: So what is a good credit score?

Answer: It depends! Different lenders, businesses, and services providers use different criteria for what THEY consider a “good” credit score. Typically, though, FICO scores range from 300-850 and can be classified as follows:

- Exceptional (800-850)

- Very Good (740-799)

- Good (670-739)

- Fair (580-669)

- Poor (300-579)

The higher your credit score, the more likely you are to qualify for credit, rental housing, insurance, etc. Basically, your credit score determines IF you’ll be able to borrow money and how much it will cost you.

For more information on borrowing basics, watch the video below: